Customer Onboarding Software helps automate procedures, decreasing the workload for teams and the firm. This prevents users from having to go through a time-consuming account opening process. Choosing the correct customer onboarding solution is critical for businesses to elevate their accounts.

In today’s digital landscape, consumers want flawless experiences from the first interaction. The initial phase of interaction is crucial for every organisation since it has a big impact on the brand’s image in the minds of customers.

Before your clients can use your products and services, guide them through a seamless and efficient account opening process. This will improve consumer interactions and retention. While old human onboarding methods are limited and entail security problems, the introduction of account opening software has transformed this critical business stage.

What is account opening Software?

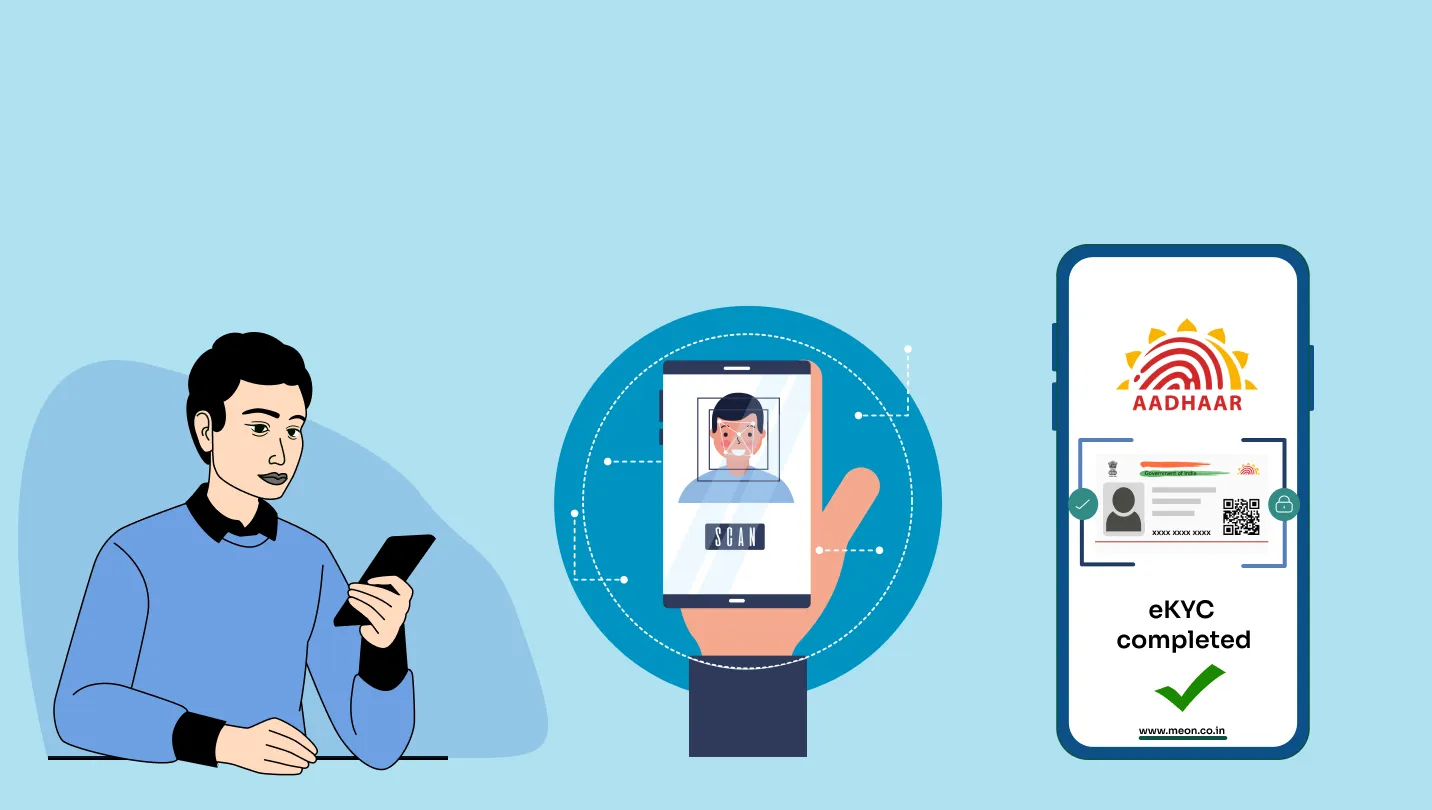

Account Opening Software, such as Aadhaar eKYC solutions, simplifies the process of adding new clients to your business, allowing them to access your services or goods with ease. Integrating this customer onboarding solution into your system enables businesses to engage with more consumers, automate procedures, and make a strong first impression

Customer onboarding is more than just product engagement; it is essential for developing long-term relationships with your consumers. Enterprises may improve the consumer experience, guarantee clients get more value out of the service, and remove barriers to the eKYC procedure by improving the customer onboarding process.

Improving Customer Onboarding: Important Benefits of Aadhaar eKYC Online

Aadhaar eKYC (Electronic Know Your Customer) online is an excellent customer onboarding solution for a variety of compelling reasons. Because each organisation is unique, with clients with varying wants and aspirations, a tailored onboarding process is crucial. Investing in Aadhaar eKYC Provider is a strategic option for businesses looking to reduce churn and increase customer retention by enabling simple and secure interactions between customers and brands. This technology enables organisations to adjust their account opening processes to meet unique operational demands and client preferences, hence improving the entire onboarding experience.

Improving the client introduction with the Digital KYC solution

Digital KYC Solution transforms client onboarding for organisations, particularly when it comes to managing large amounts of consumer information in the face of severe market rivalry. By digitising the process, it provides a seamless experience that eliminates the need for physical interaction during account creation. Using Aadhaar OTP verification simplifies identity verification while improving security and accuracy. Conventional KYC techniques include inherent risks, ranging from security flaws to potential inaccuracies. Aadhaar eKYC Services successfully mitigates these concerns. Its implementation serves as a strong disincentive to money laundering and terrorism financing, protecting both businesses and consumers.

In today’s changing landscape, the Aadhaar eKYC Online process stands out as a cost-effective option that eliminates the need for physical documents and manual verification. Its seamless integration into the digital domain meets the increased demand for efficiency in an ever-changing world. By automating data collecting and verification, Aadhaar-based Digital eKYC dramatically decreases the expenses of manual labour, paper handling, and storage, while also lowering the chance of errors.

One of the most notable benefits is the reduction in turnaround time. Unlike the time-consuming manual KYC procedure, which frequently results in lower customer retention rates due to human errors, Digital KYC speeds onboarding, requiring only five minutes to set up new client accounts. This quick procedure, aided by Aadhaar-based eKYC Online, avoids the weeks or months typically

Improve Data Security:

Ensuring the confidentiality of clients’ sensitive data is critical for preserving confidence and protecting reputation, especially when traditional KYC procedures entail dangers. eKYC service providers use advanced security procedures to protect personal information from unauthorised access. These systems strengthen defences against criminal breaches by implementing encryption, secure data storage, and controlled access procedures, with user data privacy as a top priority.

Enhance Regulatory Compliance:

The eKYC provider’s platform creates a strong compliance framework to combat illicit financial transactions and terrorist financing activities. By incorporating account opening software within the eKYC Services Provider, users may easily adhere to changing regulatory regulations. This interface enables real-time updates on regulatory changes, reducing the risk of noncompliance penalties for financial institutions. Additionally, the system performs precise background checks.

Optimise your account opening process with Meon Digital eKYC services.

Meon Technologies is at the forefront of Digital eKYC Services, revolutionising the way businesses onboard clients. Say goodbye to time-consuming paperwork and hello to convenient digital account openings. Our Aadhaar eKYC Software simplifies the process by eliminating documentation hurdles and minimising rejections, all while lowering dependency on manual interaction. We offer a fast and error-free experience by integrating Autopush with CDSL, NSDL, KRA, UCC, and CKYC. Using powerful optical character recognition technology increases efficiency by quickly discovering and dismissing discrepancies.

In summary

Transform your business with cutting-edge technology that not only saves money but also streamlines the difficult account opening process. Our Digital KYC solution leverages the power of Aadhaar to ensure seamless verification against the UIDAI database. With strong security measures in place, fraud risks are reduced, and clients are no longer required to physically show numerous identity and address documents. The Aadhaar OTP provides an additional degree of protection, protecting users’ identities like never before. Partner with us for a smooth, secure, and customer-friendly onboarding process.

Original reference – https://aadhaar-ekyc.odoo.com/blog/aadhaar-ekyc-2/optimising-account-oening-using-advanced-customer-onboarding-software-2